do you have to pay sales tax when selling a used car

You do not need to pay sales tax when you are selling the vehicle. Although trade or dealer discounts are taken off from the sales price any.

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

You will register the vehicle in a state with no sales tax because.

. After the title is transferred the seller must remove the license plate. On the other hand if you bought a car. The maximum tax that can be owed is 475.

If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. The state charges a 7 sales tax on the total car price at the moment of registration. In this scenario Florida will collect six percent sales tax on 31000 which is the advertised price of.

If you sell your car for more than you originally paid for it you will owe capital gains tax. In California the sales tax on new and used vehicles is 725. Ultimately you pay 28000 for the car saving 12000 off the original price.

Theres also an added county tax depending on where the purchase takes place. In fact a new vehicle is. How much tax do you pay on a car in Mississippi.

Depending on where you live when you buy a used car from a private party you most likely will be responsible for sales tax. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. You have to pay sales tax on a used car.

Furthermore you will have to calculate your taxes alone and submit the documentation when registering a car. Toyota of Naperville says these county taxes are far. If I Sell My Car Do I Have to Pay Taxes.

The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. There are some circumstances where you must pay taxes on a car sale. You can avoid paying sales tax on a used car by meeting the exemption circumstances which include.

The buyer is responsible for paying the sales tax. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. So if your used vehicle costs 20000.

However you do not pay that tax to the car dealer or individual selling the. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. Some areas even have an.

Thankfully the solution to this dilemma is pretty simple. The short answer is maybe. If for example you.

In some places a use tax applies. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. Although a car is considered a capital asset when you originally purchase it both state.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Georgia Bill Of Sale Form For Vehicles

/cloudfront-us-east-1.images.arcpublishing.com/gray/57OSO4S3IBB5BBZ62CMR42TL5Y.jpg)

Used Car Sales To Change In Texas

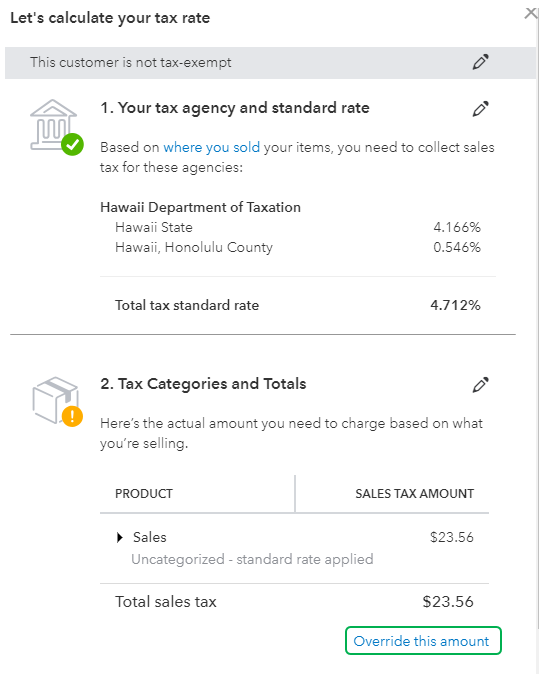

Solved Should I Enter My Sales Tax As An Expense Every Time I Pay It Or Is That Automatically Figured Into My Profit And Loss Statement From The Sales Tax Program

Sell My Car In Cincinnati Oh Used Car Buyer And Auto Trade Ins Kings Toyota

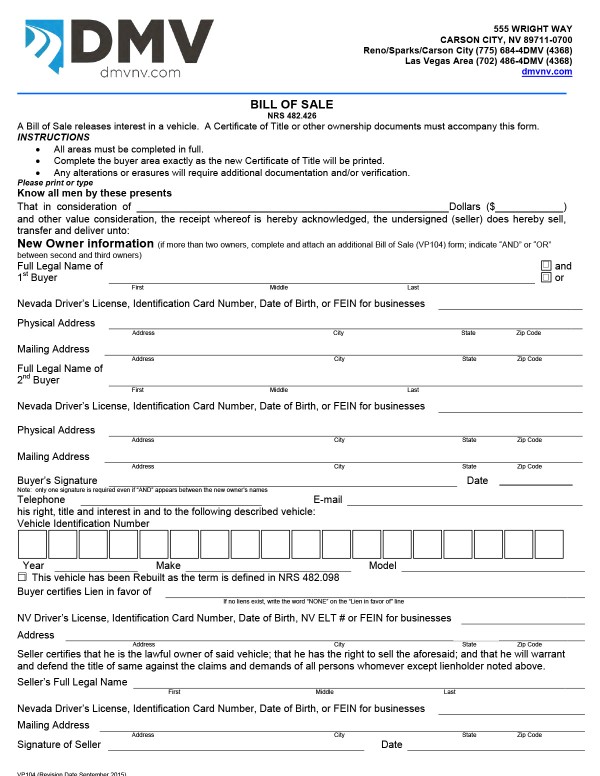

All About Bills Of Sale In Nevada The Forms Facts More

How To Save On Taxes When Buying And Selling A Car In Ohio Progressive Chevrolet

Massachusetts Used Car Sales Tax Fees

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Can Buy A Car Below Market Value And Resell It For A Profit Without Registering And Paying Taxes On It In California Quora

Price Jump For Used Cars Results In Boost In Michigan Sales Tax Collected Michigan Thecentersquare Com

How To Buy A Car Out Of State Nextadvisor With Time

Will I Pay Sales Tax When Buying My Leased Car Fox Business

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Do You Pay Sales Tax On A Lease Buyout Bankrate

What To Know About Taxes When You Sell A Vehicle Carvana Blog

New York Vehicle Sales Tax Fees Calculator

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis